Canada doesn't have that many hotel credit cards to choose from, but the

Since it's tied in with Marriott Bonvoy, you'll have access to over 7,000 hotels around the world, as well as 40 airline partners you can transfer your points to.

That's a quick summary of all the good points, but just to be fair, we've got a full analysis of this hotel card, including things to look out for.

Read on for all you should know about this Marriott Bonvoy credit card.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Earn Marriott Bonvoy points

Every time you use your card, you’re earning points that you can use towards Marriott Bonvoy stays, among many other things.

How many points will you earn, exactly?

With the

- 5 points per $1 spent at Marriott properties

- 2 points per $1 spent on all other purchases

For a complete breakdown of what your points are worth, check out our American Express Marriott Bonvoy rewards program analysis.

How many points do you need to earn to get a free night?

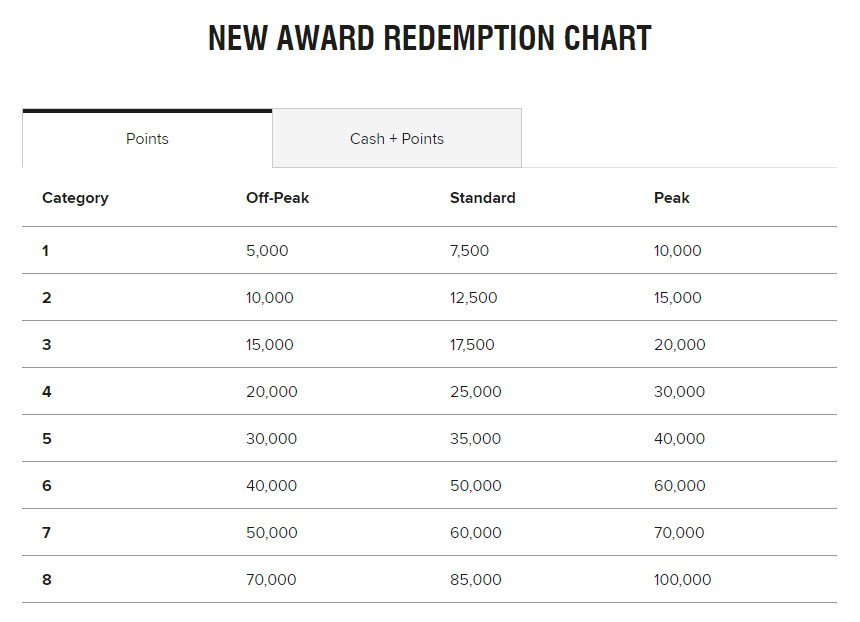

Well, it depends. Marriott hotels are divided into 8 categories and each hotel is assigned a category number. The higher the category number, the more points you’ll need to redeem for a free night.

The higher-end hotels are assigned a higher category number since staying at one of these locations is generally more expensive, whether because of better location or higher-quality accommodations.

There’s also peak and off-peak pricing. When a hotel is busier, you’ll see peak pricing, and when it’s not, off peak pricing. Standard rates lie somewhere in between.

Here’s a table showing the points required for each hotel category.

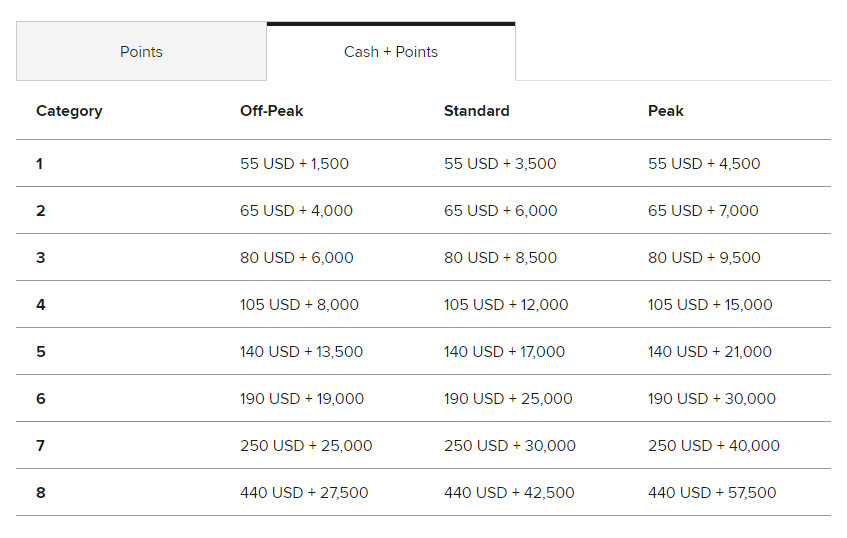

And, there’s also a cash and points chart, in case you want to redeem and don’t have enough points saved up.

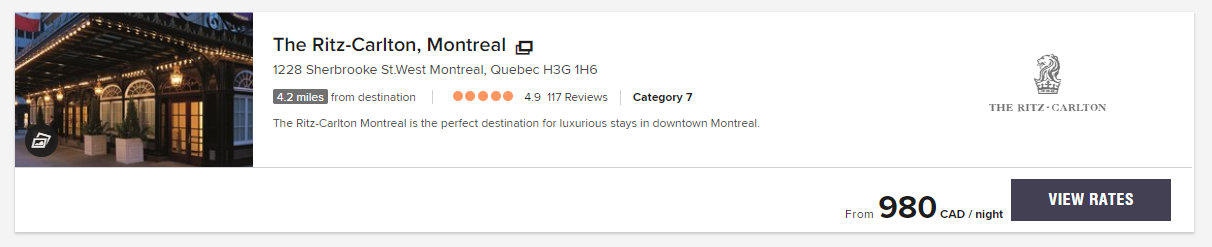

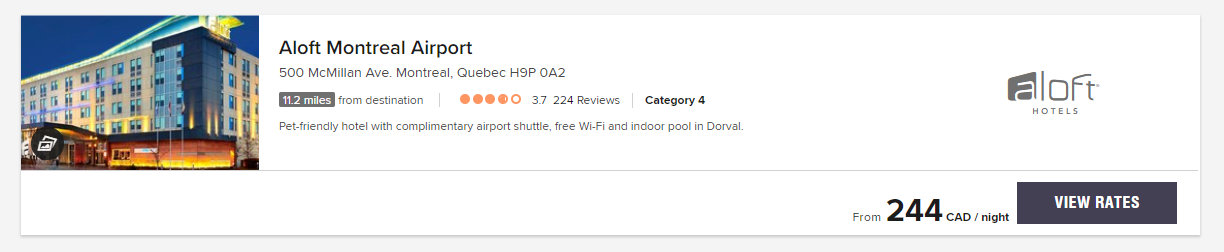

Here’s a few examples of various hotels and their prices.

Marriott Bonvoy category 7 hotel

The Ritz-Carleton in Montreal, for example, starts from $980 per night, and is assigned to category 7.

Marriott Bonvoy category 4 hotel

On the other hand, the Aloft Montreal Airport hotel starts from $244 per night and is assigned to category 4.

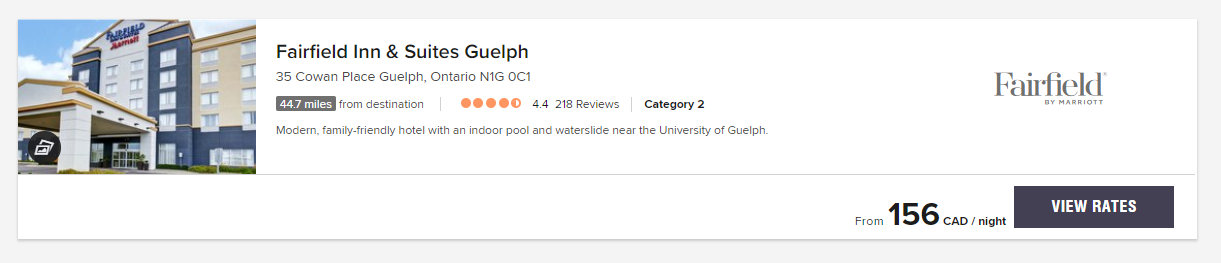

Marriott Bonvoy category 2 hotel

And finally, here’s an example of a hotel assigned to category 2 in Guelph, Ontario, starting at $156 per night.

Marriott Bonvoy welcome bonus

As for a welcome bonus, you’ll be able to earn 110,000 Marriott Bonvoy points after spending $6,000 in the first 6 months and making a purcahse in month 15. That’s enough points to pay for up to 4 nights at a category 2 hotel, or up to 2 nights at a category 4 hotel.

Marriott Bonvoy credit card insurance coverage

Aside from the typical purchase insurance included with most cards, the Marriott Bonvoy card also includes some coverage for hotel burglaries and delayed, lost, or stolen baggage. So, if anything ever happens to your belongings on your travels, you’ll have some added peace of mind.

Here’s a comparison with the Best Western card to illustrate the differences in insurance coverages:

| Credit Card Insurance | American Express Marriott Bonvoy | Best Western Rewards Mastercard |

|---|---|---|

| Extended warranty | 1 year | 1 year |

| Purchase protection | 90 days | 90 days |

| Travel accident | $500,000 | $1,000,000 |

| Flight delay | $500 | N/A |

| Baggage delay | $500 | N/A |

| Lost or stolen baggage | $500 | N/A |

| Hotel burglary | $500 | N/A |

| Trip interruption | N/A | $2,000 |

| Rental car accident | N/A | $200,000 |

| Rental car theft and damage | Yes | Yes |

| Rental car personal effects | N/A | $1,000 |

| Apply Now | Apply Now |

More Marriott Bonvoy credit card perks

Another place where this card shines is with its perks – the most famous of which is the annual free night stay. This alone makes this card worth its annual fee.

What’s more, you’ll get automatically upgraded loyalty status. Just having this card in your wallet will bump you up to Silver Elite status.

Silver Elite status holders can take advantage of:

- 10% bonus points on stays,

- priority late checkout,

- a dedicated Elite reservation line,

- complimentary Wi-Fi,

- reservation guarantees, and

- exclusive member rates, among other benefits.

And when you spend $30,000 on the card annually, you’ll even get bumped up to Gold Elite status. Gold Elite status holders can take advantage of:

- 25% bonus points on stays,

- room upgrades,

- 2pm late checkout,

- points welcome gifts,

- and more.

On top of all that, you get 15 Elite night credits every calendar year, which can be used towards reaching your next Elite status level.

Marriott Bonvoy credit card requirements

For most travel credit cards, the income requirements can be quite high, usually $60,000, $80,000, and even $200,000 for higher-end credit cards.

But for the

As for credit score, if you have fairly good credit, you have a good chance at getting approved for this card.

How the new Marriott Bonvoy compares to the old SPG

If you’ve been on the fence with this card because of its recent rebranding, we’re here to set your mind at ease.

There isn’t anything different between the old and the new – aside from a shorter, catchier name and a new card design.

| Marriott Bonvoy Rewards | Old SPG Rewards | |

|---|---|---|

| Earn rates | * 5 points per $1 spent at Marriott properties * 2 points per $1 spent on all other purchases |

* 2 points per dollar spent * 5 points per dollar spent at SPG and Marriott locations. |

| Annual fees | $120 | $120 |

| Insurance coverage | 8 different insurance coverage | 8 different insurance coverage |

| Perks | * Transfer points to over 40 airline partners * Annual free night * Automatic Silver Elite status * Automatic Gold Elite status after spending $30,000 annually on the card |

* Transfer points to over 40 airline partners * Annual free night * Automatic Silver Elite status * Automatic Gold Elite status after spending $30,000 annually on the card |

Any downsides?

Although this card has great redemption value when redeeming for hotel stays or transferring to airline partners, it leaves something to be desired when it comes to other redemption methods.

For example, the average point value when redeemed for car rentals is a disappointing 0.13 cents per point.

You’re getting a slightly better value when redeeming for gift cards or merchandise, but not much more: 0.34 and 0.37, respectively.

If you value these kinds of redemption methods, there are better options available.

And as with any American Express card, its biggest downside is limited acceptance. No matter how great this card is, if American Express isn’t accepted at your go-to shops, it might not be the best fit for you.

The bottom line

Whether you like the new changes to the Marriott Bonvoy card or not, it still stands as the best hotel credit card available in Canada. The perks it carries make it worth its annual fee (and then some), providing you with truly outstanding value.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 3 comments