Hometown Rewards, the rewards program for Irving gas, might not be one of the biggest loyalty programs, but it does allow you to earn Air Miles at an increased rate. By linking your Air Miles credit card, you can earn discounts on fuel while maximizing your miles.

We’ll explain the limitations of this gas rewards program so you can decide if it’s worth downloading the app. If you don’t mind using the program, it’s a pretty easy way to score some Air Miles, get discounted fuel, and enjoy a sweet treat on your birthday.

Note: In summer 2026, Air Miles will rebrand as Blue Rewards.

Key Takeaways

- Irving Hometown Rewards allows you to earn Air Miles on your Irving gas station purchases.

- With Hometown Rewards, you can earn bonus Air Miles and get fuel discounts.

- Enjoy a free slice of pie or cake every year on your birthday at an Irving Big Stop restaurant.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

What are Hometown Rewards?

Hometown Rewards is the loyalty program offered by Irving gas stations. Before we dig into the program’s details, take a look at the provinces where the program operates so you can find out if it’s available near you:

- Newfoundland

- Nova Scotia

- Prince Edward Island

- New Brunswick

If you live in Ontario or Quebec, you don’t have access to Hometown Rewards, but you can participate in Irving Rewards. This basic program simply gives you fuel rewards.

How to set up and use Irving Hometown Rewards

It’s free and easy to join Hometown Rewards. Just complete the following steps:

- Enter your name and email address

- Provide your Air Miles number and personal details. Enter your postal code, birthdate, and phone number.

- Check your email. You’ll need to verify your account to get started.

- Access rewards and offers in your account. See what offers you qualify for, find out how to earn rewards, locate your nearest Irving gas station, or access your Air Miles earnings after you link your card.

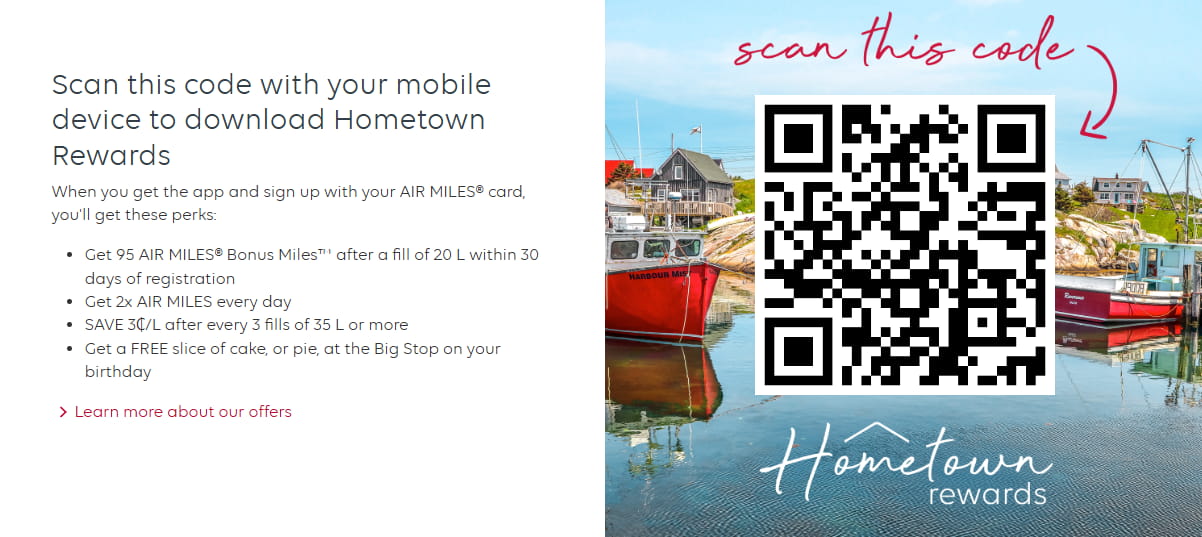

You can also access your Hometown Rewards account on their app!

How to earn Hometown Rewards

It’s easy to earn Air Miles and fuel discounts at Irving gas stations. The program gets you started with a nice welcome bonus. Although it may change, the current offer is 200 bonus Air Miles once you link your Air Miles card with your account and make a 20-litre purchase.

Save 3 cents per litre on fuel

To earn rewards going forward, just swipe your Air Miles credit card when fuelling up or making purchases inside the gas station. Then, after every 3 purchases of 35 litres or more, you earn 3 cents off per litre (up to a max of 100 litres).

Earn bonus Air Miles on fuel purchases

For a limited time, when you swipe your card and purchase over 20 litres of fuel, you’ll get 200 bonus Air Miles added to your account. This is on top of earning 2x the Air Miles you get by participating in the program. You’re essentially double-dipping when it comes to earning rewards.

Since this is a promotional offer, Irving may update it in the future.

How to redeem Hometown Rewards

The Air Miles you earn will automatically be deposited into your Air Miles account, but if you want to redeem your fuel discount, here’s what to do:

- Select pay inside when you’re at the fuel pump and fuel up your vehicle.

- Head inside and open your Hometown Rewards app.

- Click the Rewards tab and select your reward.

- Within five minutes of selecting the reward, have a team member scan the barcode.

- Scan your Air Miles card so you can continue to earn rewards.

As a Hometown Rewards member, you can enjoy a nice birthday perk: a free slice of pie or cake. You’re not even required to make any other purchases at the Big Stop.

How much are Hometown Rewards worth?

Some might argue the free birthday cake or pie is enough to make the program worth it, but if you’re looking at point value, 95 Bonus Miles = $10. (Note that as of January 25, 2026, Cash Miles and Dream Miles have merged into a single Miles balance.)

This gives you 10.5 cents per point. Not bad for a gas station rewards program.

FAQ

What is the Irving Hometown Rewards program?

The Irving Hometown Rewards Program the Irving gas station loyalty program that earns you Air Miles and discounts on fuel. You’ll also get sweet rewards like a slice of pie or cake on your birthday.

How do my Hometown Rewards work?

Once you sign up, scan your Air Miles card whenever you make a purchase at participating Irving gas stations. This way, you’ll earn Air Miles and fuel discounts once you’ve met the purchase requirements.

What is the Hometown Rewards app?

If you prefer to use an app rather than log in to an account online, you can download the Hometown Rewards app. The app makes it easy to manage your rewards and offers while you’re on the go.

How do I check my Irving Rewards balance?

Log in to your account online or in the app and select the Rewards tab. You’ll see all the rewards you’ve earned as well as when they expire. Be aware that Air Miles don’t expire as long as your account is active.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.