Pros & cons

Pros

- Up to 200,000 bonus points.

- $200 anniversary lifestyle credit.

- Up to 5 points per $1 spent on purchases.

- 25% bonus points when you add an authorized user.

- Get 6 free complimentary lounge passes.

- Includes 12 types of insurance.

Cons

- Low point value of 0.67.

- High income requirements of either $150,000 personal or $200,000 household.

Your rewards

$250 GeniusCash offer

On approval, receive $250 GeniusCash on us when you apply for BMO eclipse Visa Infinite Privilege Card using this offer page.

GeniusCash offer expires on Feb 28, 2026.

Getting your welcome bonus

Based on $3,000 in monthly spending, you can get up to 80,000 points which translates to an estimated $536.◊

For all welcome bonus details click here.

Welcome bonus offer ends Oct 31, 2026.

How you earn rewards

Each card earns rewards differently. Part of choosing your card is deciding what type of rewards you want to get. With BMO eclipse Visa Infinite Privilege Card, here's how you earn rewards:

- 5x BMO Rewards points for every $1 spent on travel , dining , gas , groceries , and drugstores

- 1 point per $1 spent on all other purchases

For all reward details click here.

How much your rewards are worth

The dollar value of your rewards depends on the specific rewards program ‒ and what you choose to redeem your points for. For BMO eclipse Visa Infinite Privilege Card in particular, if you spend $3,000 per month, here's our estimated annual rewards earned depending on which reward you choose:

| Travel | $675 | |

| Investments | $675 | |

| Experiences | $655 | |

| Gift Cards | $564 | |

| Merchandise | $544 |

Calculating your annual rewards

$36,000 annual spending x 1.88% return on spending = $675 annual rewards

$675 annual rewards − $599.00 annual fee = $76 net annual rewards

Details and eligibility

- Estimated Credit Score

- 560 - 659

- Personal Income

- $150,000

- Household Income

- $200,000

- Annual Fee

- $599.00

- Extra Card Fee

- $99

- Card type

- Credit

- Purchase

- 21.99%

- Cash Advance Δ

- 23.99%

- Balance Transfer Δ

- 23.99%

- Balance Transfer

- 0.00%

- Transfer Term

- 12 months

Insurance coverage

- Extended Warranty

- 2 years

- Purchase Protection

- 120 days

- Mobile Device

- $1,000

- Travel Accident

- $500,000

- Emergency Medical Term

- 22 days

- Emergency Medical Maximum Coverage

- $5,000,000

- Emergency Medical over 65

- 3 days

- Trip Cancellation

- $2,500

- Trip Interruption

- $5,000

- Flight Delay

- $1,000

- Baggage Delay

- $500

- Lost or Stolen Baggage

- $1,000

- Hotel Burglary

- $2,500

- Rental Car Theft & Damage

- Yes

Please review your insurance certificate for details, exclusions and limitations of your coverage, terms and conditions apply.

Learn more about the value of credit card insurance coverage.

Genius Rating

BMO eclipse Visa Infinite Privilege Card's 5.0 Genius Rating is based on the weighted average of the following scores:

Methodology

All scores are produced by our math-based rating algorithm that takes into account over 126 credit card features.

Top cards from BMO

BMO eclipse Visa Infinite Privilege review

The BMO eclipse Visa Infinite Privilege lets you earn valuable and flexible BMO Rewards on all of your spending, with 5x points on groceries, gas, dining, travel, and drugstore purchases.

On top of this, you'll get some premium travel benefits and other goodies, but are these worth the exceptionally high annual fee?

And what are these rewards points really worth? As a rewards credit card rather than a cash back card, it can be a bit harder to figure out exactly what you're getting for your rewards, and what your actual return on spending might look like.

BMO eclipse Visa Infinite Privilege rewards

Like its little brother, the BMO eclipse Visa Infinite Privilege credit card earns BMO Rewards, which is the Bank of Montreal's own flexible rewards program.

Earning BMO Rewards

You'll kick off your BMO Rewards collecting with a generous welcome bonus of up to 200,000 points, after which you'll earn:

- 5x BMO Rewards points for eligible travel, dining, gas, groceries, and drugstore purchases, and

- 1 point per $1 spent on all other eligible purchases.

One interesting new feature of this credit card is the rewards boost you get when you add an authorized user to your account.

While you'll have to pay an annual fee of $99 each time, adding an authorized user will increase your rewards earn rate by 25%.

This is a rewards earn rate bonus, which you get on top of having a second user helping you rack up those rewards more quickly in the first place.

Redeeming BMO Rewards

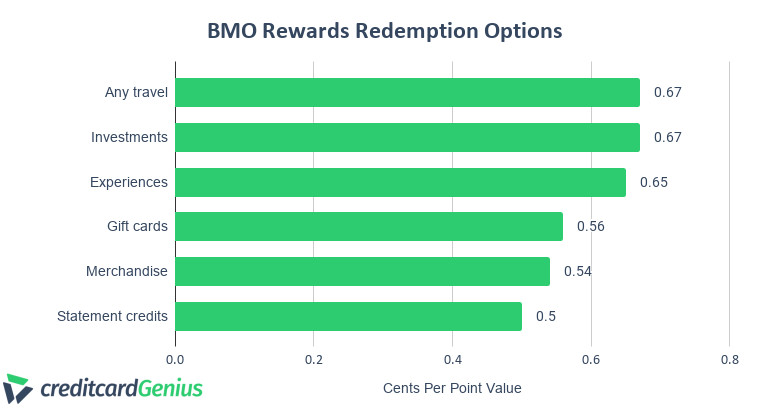

The value of BMO Rewards points depends on how you're redeeming them. There are a number of redemption options available, giving you some good flexibility in how you ultimately use your rewards.

Here's the estimated value of BMO rewards for the various redemption options available.

| Redeem for... | Estimated cents per point (CPP) value |

|---|---|

| Any travel | 0.67 CPP |

| Investments | 0.67 CPP |

| Experiences | 0.65 CPP |

| Gift cards | 0.56 CPP |

| Merchandise | 0.54 CPP |

| Statement credits | 0.5 CPP |

As with many rewards programs in Canada, redeeming your points for travel will give you the best value for your points, but even the least valuable option – statement credits – still gives you some decent value.

If you're earning 5x points for groceries, gas, or travel purchases, for example, the estimated rate of return for each of these options would be roughly:

- Any travel: 3.35%

- Investments: 3.35%

- Experiences: 3.25%

- Gift cards: 2.8%

- Merchandise: 2.7%

- Statement credits: 2.5%

If you redeem your BMO Rewards for statement credits, that's essentially like getting cash back, since you can use them to pay off eligible purchases you've made with your credit card.

And while these earn rates look pretty good, you have to remember that you're only getting 5x points on a handful of categories. For most purchases you'll only earn 1 point per $1 spent, which lowers your rate of return significantly.

At a 1 point per $1 earn rate, the estimated rate of return for this credit card drops to a mere 0.5% to 0.67%.

Maximizing your BMO Rewards

Maximizing your BMO Rewards value can be tricky, but we've written an extensive and detailed guide to this flexible rewards program. We dig into the details, do the calculations, and help you maximize your BMO Rewards.

7 BMO eclipse Visa Infinite Privilege benefits

There are 7 primary reasons to take a look at the BMO eclipse Visa Infinite Privilege.

1. 200,000 point welcome bonus

You start off with a welcome bonus of up to 200,000 points, earning:

- 50,000 BMO Rewards points after spending $6,000 in the first 3 months,

- 30,000 point after spending $30,000 in the first 6 months, and

- another 40,000 points after spending $75,000 in the first year.

The most valuable way to redeem BMO Rewards is for travel, of course, and 200,000 points would be worth approximately $1,340 if redeemed in that fashion.

2. 25% bonus rewards with an authorized user

If you add an authorized user to your account, you will both get a 25% boost to the rewards you earn, on top of just earning rewards more quickly by having 2 people participating.

And while this is a nice bonus, each additional card you add to your account costs another $99 per year. It's up to you to figure out if that makes sense for you or not.

3. $200 annual lifestyle credit

One thing that does offset the high annual fee a little bit is the automatic $200 lifestyle credit you'll receive every year.

All you have to do to get this credit is to make any purchase of $200 or higher in any year you have the card. The lifestyle credit will automatically be applied to your statement some time after you make the first eligible purchase in a given year.

What could be easier?

4. Premium travel benefits

This credit card comes with a complimentary Priority Pass membership, and 6 annual lounge visits. This is something you'll have to enroll in separately, but once you have your Priority Pass card, you'll be able to access any Priority Pass lounge.

A Priority Pass membership normally costs US$99 per year, and each visit normally costs US$32, making those 6 complimentary passes worth $192 alone.

Of course as a Visa Infinite Privilege card, you'll also get access to all those sweet Visa Infinite perks, including:

- Visa Infinite Dining,

- Visa Infinite Wine Country,

- Visa Infinite Luxury Hotels,

- Visa Infinite Privilege concierge service, and

- Visa Infinite Troon Golf Benefits.

5. 12 types of complimentary insurance coverage

Of course, as a premium travel rewards credit card, the BMO eclipse Visa Infinite Privilege card comes with a premium package of complimentary travel insurance and purchase protection.

The card includes the following, at no extra cost to you:

BMO eclipse Visa Infinite Privilege* Card

| Extended Warranty | 2 years |

| Purchase Protection | 120 days |

| Mobile Device | $1,000 |

| Travel Accident | $500,000 |

| Emergency Medical Term | 22 days |

| Emergency Medical Maximum Coverage | $5,000,000 |

| Emergency Medical over 65 | 3 days |

| Trip Cancellation | $2,500 |

| Trip Interruption | $5,000 |

| Flight Delay | $1,000 |

| Baggage Delay | $500 |

| Lost or Stolen Baggage | $1,000 |

| Hotel Burglary | $2,500 |

| Rental Car Theft & Damage | Yes |

Please review your insurance certificate for details, exclusions and limitations of your coverage.

6. Free credit score monitoring

Any BMO customer gets access to free credit score monitoring through the CreditView service. Simply log into your BMO account on the web or through the BMO mobile app, and you'll have 24/7 access to your current credit score.

7. Enhanced security features

With credit card theft and fraud often in the news, being concerned about the safety and security of your card is only natural.

BMO gives you some added peace of mind with their enhanced credit card security features that let you lock, unlock, or report your credit card lost or stolen at any time, whether you're at home or on the road.

5 BMO eclipse Visa Infinite Privilege downsides

The BMO eclipse Visa Infinite Privilege has a lot going for it, but you'll have to stomach an exceptionally high annual fee and high interest rates, among other things.

1. Extremely high annual fee

Where there are premium perks and benefits, there is often a high annual fee close behind.

The BMO eclipse Visa Infinite Privilege offers some excellent value in terms of rewards, benefits, travel perks, welcome bonus, and insurance...but you're going to pay for it.

This credit card has an annual fee of:

- $599 for the primary cardholder, and

- $99 for each additional cardholder.

If you can make full use of this credit card's features, and maximize the value of the rewards you collect, you might be able to justify paying this high a fee, but it's definitely out of sensible range for the majority of Canadians.

2. Annual fee is not waived for the first year

And adding insult to injury is the fact that the annual fee is not waived for the first year you have this card. You have to commit to paying that exceptionally high annual fee before having a chance to take the card for a test drive to see if it's worth it for you and your family.

That's a bit of a shame, really, because it's easy to see the potential value in this card, but harder to really sort out if it would make sense on a day to day basis.

3. High interest rates

While most credit cards have high interest rates hovering in and around the 20% mark, the BMO eclipse Visa cards have interest rates that are slightly higher than average across the board. Both this and the BMO eclipse Visa Infinite card have the following interest rates:

- Purchases: 21.99%

- Cash advances: 23.99%

- Balance transfers: 23.99%

4. Very high income requirements

The income requirements for this credit card are also very high, coming in at:

- $150,000 personal, or

- $200,000 household.

This isn't unusual for Visa Infinite Privilege cards, but it is something you need to be aware of before applying for this credit card.

And this income requirement is in addition to any credit score requirements, which are likely to also be very high.

5. Expensive additional cards

And finally, if you want to add an authorized user to your account, you'll pay $99 per added user, per year for the privilege.

Now, this does give you the 25% bonus earn rate on your BMO rewards, so it may make sense for you to do this, but that's something you'll have to sort out based on your personal spending and rewards utilization.

BMO eclipse Visa Infinite Privilege vs. the BMO eclipse Visa Infinite

If you're not interested in paying a $599 annual fee, the BMO eclipse Visa Infinite Privilege has a little brother that is less expensive (and it also waives that annual fee for the first year you have the card).

| Feature | BMO eclipse Visa Infinite Privilege | BMO eclipse Visa Infinite |

|---|---|---|

| Welcome bonus | 200,000 points (terms) | 80,000 points (terms) |

| Annual fee | $599 | $120 (waived for the first year) |

| Rewards | * 5x points for every $1 spent on groceries, dining, drugstore purchases, gas, and travel * 1 point for every other $1 spent on eligible purchases |

* 5x points for every $1 spent on groceries, dining, gas, and transit purchases * 1 point for every other $1 spent on eligible purchases |

| Bonus rewards | 25% more points when you add an authorized user to your account | 10% more points when you add an authorized user to your account |

| Lifestyle credit | $200 | $50 |

| Travel benefits | Complimentary Priority Pass membership, plus 6 annual lounge visits | None |

| Insurance coverages | 12 types | 7 types |

| Special features | * Visa Infinite Privilege Concierge * Visa Infinite Dining * Visa Infinite Wine Country * Visa Infinite Luxury Hotels * Visa Infinite Troon Golf Benefits |

* Visa Infinite Concierge * Visa Infinite Dining * Visa Infinite Wine Country * Visa Infinite Luxury Hotels * Visa Infinite Troon Golf Benefits |

| Income requirements | * Personal: $150,000 * Household: $200,000 |

* Personal: $60,000 * Household: $100,000 |

These 2 credit cards have similar rewards earn rates, but the Visa Infinite Privilege has the additional bonus earn rate for travel and drugstore purchases. And the less expensive card also lacks the premium travel benefits, has fewer types of included insurance coverage, and additional users only add a 10% bonus to your rewards earn rate.

Bottom line

In the end, this is an expensive credit card to keep in your wallet, but if you're a frequent traveller who can make full use of this card's perks and benefits, it might just be worth it to you.

FAQ

Does the BMO eclipse Visa Infinite Privilege include any travel perks?

It does. You will receive a complimentary annual Priority Pass membership, that is valued at US$99. On top of that, you'll get 6 complimentary lounge passes every year. As these normally cost US$32 each, that's another $197 value.

What is the annual fee for the BMO eclipse Visa Infinite Privilege?

This credit card has an exceptionally high annual fee of $599 for the primary cardholder, and $99 annually for each additional authorized user. Its little brother, the BMO eclipse Visa Infinite has a $120 annual fee, and $50 annually for each additional authorized user.

Will I earn rewards with the BMO eclipse Visa Infinite Privilege card?

You will earn flexible BMO Rewards with this credit card. We talk more about what these rewards are worth and what you can redeem them for here. Read more about both of the BMO eclipse credit cards.

Key benefits

BMO is not responsible for maintaining the content on this site. Please click on the Apply now link for the most up to date information.

User reviews

Reviewed by 6 Canadians

Thank you for your review!

Hang tight while we verify and approve it.

If you want to see your review right away...

Create an account:

This card and is lesser brother/sister would be great EXCEPT the bonus points only count for purchases made in Canada. Found out the hard way.

It's meh. Do you really want to pay this much for meh?

Probably the best is insurance. I have not had to use it, so am thankful for that. However, coverage does seem great in this regard. I cannot comment on how easy it is to use if needed.

The rewards are meh. Seems the other cards at this tier do it much better.

The airport lounge pass is limited. I used to use it with another service pre-COVID. Now it seems you need to be in the right airports and they are "meh". Great places to sit instead of the gate. Food and spirits leave something to be desired. So good places to do work or, well, lounge. Not so great to eat or drink.

The Visa portal and airport portals are terrible. Seems to be riddled with login issues for no reason.

Crave TV discount is well, something. Probably not a selling point.

Overall, not really worth the price.

Update from my last comment: the rebate on the annual fee with a premium chequing account is actually $150. Pretty decent, just wished BMO would bump up the return on all other purchases to match the world elite rewards at 2x points or 2.75 points per dollar spent everywhere else. This is a keeper card if you can get hold of it, especially that 25% rate with an authorized user based on your needs.

Here`s why BMO`s Visa infinite privilege outways the $699 Platinum card benefits from American Express:

BMO offers a $200 annual lifestyle credit, watch your BMO Rewards points accelerate to 25% more points when you add an authorized user. Some in the comments indicated their reward points are worth lesser per point compared to Amex, well that's true to a certain extend. However, most VISA`s are usually more preferred or accepted than AMEX. Can you find an AMEX branch near you? Exactly! If you`re a BMO client with a premium chequing account, you obtain another $120 waiver. This premium card annual fee effectively plunges to $179. Sweet eh? Sorry Amex!! You get more out of a BMO VIP card than Amex platinum. It is rare to see banks in Canada offer such competitive rates compared to Americans. Kudos to Bank of Montreal!

I hate how BMO uses less than 1 cent value per point as many/most other cards do. This card just seems like a way to screw over their customers. Get an AMEX card instead.

$250 GeniusCash + Earn up to 200,000 points + 5x points + $200 annual lifestyle credit.*

$250 GeniusCash + Earn up to 200,000 points + 5x points + $200 annual lifestyle credit.*