Depending on what you're planning, a wedding can be pricey. From catering costs, to a wedding venue and more, the amount of money you spend can escalate quickly.

So why not get something back in return for your big day? With the right credit card, you may be able to earn more rewards than you would have otherwise gotten.

Here's how to choose a credit card for wedding planning, and a few options for you to consider.

Key Takeaways

- With the right credit card, you can earn extra rewards when you're planning a wedding.

- You'll want to choose a credit card with a high base earn rate.

- Some top options include credit cards from Rogers, American Express, and Brim.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

What to look for in a credit card for wedding planning

When it comes to paying for wedding expenses, you've got lots of different places you'll need to pay. It all depends on what you're planning, but here are just some of the things you'll be paying for:

- clothing (i.e. wedding dresses, suits, etc.),

- catering,

- a venue, and

- rings, to name a few.

The things listed above generally won't fit into any standard credit card categories. So when it comes to credit cards, you'll want a credit card that has a high base earn rate on all your purchases.

What that looks like depends on if you simply want a card with or without a fee.

For a no annual fee card, you'll want to be earning at least 1% back on all your purchases.

If your card has an annual fee, aim for at least 1.5% back on everything, but preferably closer to 2%.

Best credit cards for wedding planning

So what are some of your options? Here's a listing of some top cash back credit cards you can look at.

| Credit Card | Welcome Bonus | Earn Rates | Annual Fee, Income Requirements | Apply Now |

|---|---|---|---|---|

| Rogers Red World Elite Mastercard | None | * Earn 2% unlimited cash back on all eligible non-U.S. dollar purchases if you have 1 qualifying service with Rogers, Fido, Comwave, or Shaw * Earn 1.5% unlimited cash back on eligible non-U.S. dollar purchases * Earn 3% unlimited cash back on all eligible purchases made in U.S. dollars | * $0 * $80K personal/$150K household | Apply Now |

| SimplyCash Preferred Card from American Express | 10% cash back for the first 3 months + $50 (terms) | * 4% cash back on gas and groceries * 2% cash back on all other purchases | * $119.88 * None | Apply Now |

| SimplyCash Card from American Express |  $50 GeniusCash + 5% cash back for the first 3 months (terms) $50 GeniusCash + 5% cash back for the first 3 months (terms) | * 2% cash back on gas * 2% cash back on groceries (up to $300 cash back annually) * 1.25% cash back on all other purchases | * $0 * None | Apply Now |

| Brim World Elite Mastercard | None | * 1% cash back on all purchases | * $89 * $80K personal/$150K household | Apply Now |

| Brim Mastercard | None | * 0.5% cash back on all purchases | * $0 * $15K personal | Apply Now |

1. Rogers World Elite Mastercard

The Rogers Red World Elite Mastercard is a rare no annual fee World Elite Mastercard in Canada. But even though it has no annual fee, it still offers excellent rewards, even when compared to similar cards that would have an annual fee.

Here's what this card earns for cash back on all your purchases:

- Earn 2% unlimited cash back on all eligible non-U.S. dollar purchases if you have 1 qualifying service with Rogers, Fido, Comwave, or Shaw

- Earn 1.5% unlimited cash back on eligible non-U.S. dollar purchases

- Earn 3% unlimited cash back on all eligible purchases made in U.S. dollars

Some impressive numbers for a cash back credit card. It also includes these benefits:

- 6 types of insurance,

- World Elite Mastercard benefits, and

- Mastercard Travel Pass membership (no free passes).

There are 2 catches with this card. First, even though it has no annual fee, you'll still be subjected to the usual World Elite Mastercard income requirements of either $80,000 personal or $150,000 household.

It also has a minimum annual spend requirement. You'll need to spend at least $15,000 per year on your card to maintain your eligibility, or you may get downgraded to another Rogers card.

Rogers has 1 other card you can look at if you don't (or won't be able to) meet those requirements that also provide a high rate of return everywhere.

2. American Express SimplyCash credit cards

The Amex Simply cash lineup provides plenty of rewards on all your purchases, with some bonuses on a couple of categories.

First, let's start with what the SimplyCash Preferred Card from American Express dishes out for cash back:

- 4% cash back on gas and groceries

- 2% cash back on all other purchases

Very impressive rewards that come with a monthly fee of $9.99.

If you would prefer a no annual fee card, the SimplyCash Card from American Express is also no slouch when it comes to earning cash back:

- 2% cash back on gas

- 2% cash back on groceries (up to $300 cash back annually)

- 1.25% cash back on all other purchases

Both of these cards have no income requirements to worry about either.

3. Brim Mastercards

Brim Mastercards are also excellent everywhere you shop. Let's start with the features common to all of their cards. These include:

- no foreign exchange fees,

- bonus rewards when shopping with Brim retail partners.

The only differences between them are the annual fees, rewards earned, and insurance included.

Here's what the no fee Brim Mastercard offers for rewards:

- 0.5% cash back on all purchases

It also includes 4 types of insurance.

As for the Brim World Elite Mastercard, here's what it will earn you for rewards:

- 1% cash back on all purchases

It has 12 types of insurance for a $89 annual fee and income requirements of either $80,000 personal or $150,000 household.

How to pick your own card for wedding expenses

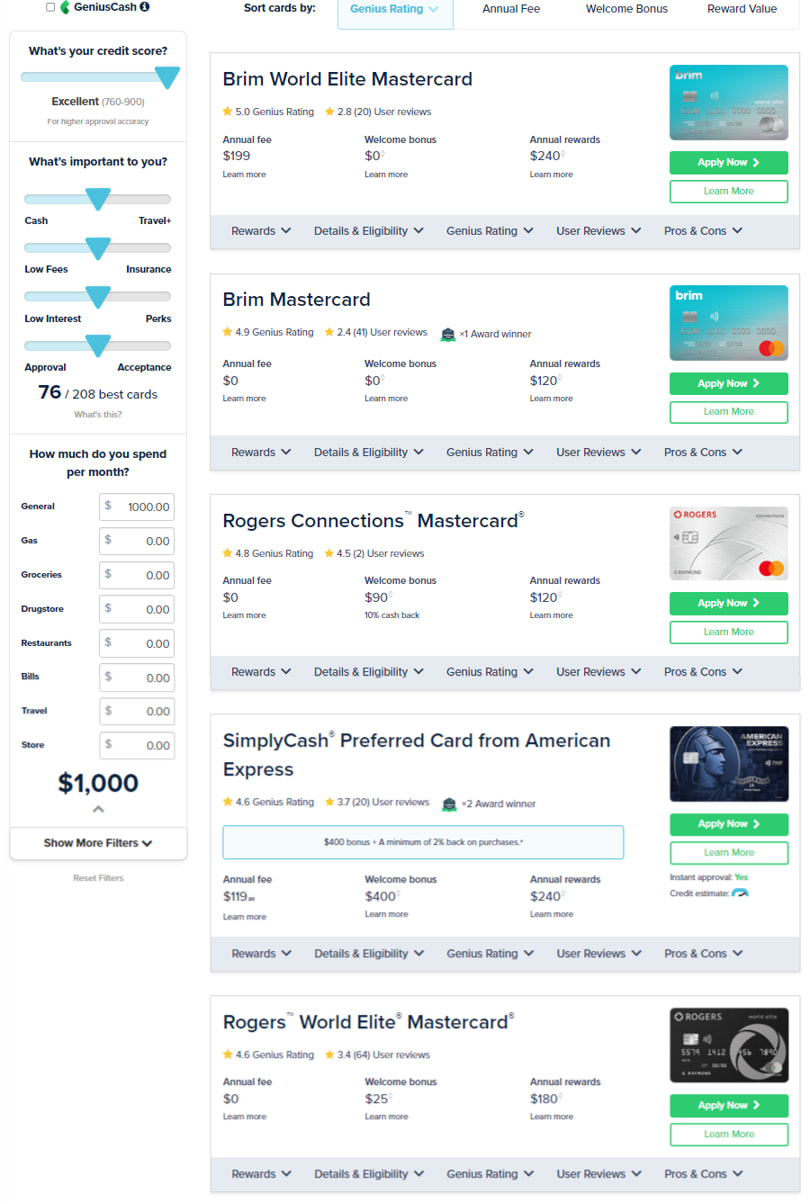

If you're looking for a more expansive list of credit cards to choose from, you can use our compare credit cards to help.

On our page, simply change the 4 sliders to your card preferences, and enter in your spending habits. In the case of credit cards for paying for wedding expenses, simply set all your spending to be general.

From there, you can sort your cards by Genius Rating or annual rewards, among others.

Your credit card for planning a wedding

We know that some things, including special performances like booking wedding lion dances, won't be covered by credit cards, but in most other cases, you can get a big chunk of rewards.

For those of you in wedding planning mode or have planned one in the past, what credit card did you use?

Share it in the comments below, and let us know why you used it.

FAQ

What should you look for in a credit card for wedding planning?

When it comes to credit cards and wedding planning, it's best to use a card with a high rate of return everywhere you shop. For no annual fee cards, you should be looking for a minimum return of 1%. For cards with annual fees, you want at least 1.5% or higher, with 2% being ideal.

What is the best cash back credit card for wedding planning?

When it comes to cash back credit cards, if you want a card with no annual fee – the Rogers Red World Elite Mastercard is your best choice as it offers 1.5% cash back everywhere. For a monthly fee of $9.99, the SimplyCash Preferred Card from American Express offers 2% cash back everywhere, with a bonus on gas and groceries.

How can I find the best credit card for wedding planning for me?

You can use our compare credit cards page to find the best credit cards for wedding planning. Select your credit card preferences and set all your spending to "General". We'll generate a list of credit cards for you to consider.

creditcardGenius is the only tool that compares 126+ features of 227 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 227 cards is for you.

×2 Award winner

×2 Award winner

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.